Welch: “You are killing small business in the United States of America.”

WASHINGTON, D.C. – During a Senate Judiciary Committee hearing today, U.S. Senator Peter Welch (D-Vt.) grilled Visa and Mastercard executives about their duopoly over the credit card market and the interchange fees—or swipe fees—charged to businesses in the United States. Senator Welch highlighted the importance of passing his bipartisan, bicameral Credit Card Competition Act (CCCA) to enhance choice and competition in the credit card market and help bring down costs for small businesses.

“A concern that I think all of us have to have is the erosion of small businesses in our small communities. They are so essential to the well-being of where we live and how we live,” said Senator Welch. “The issue here is about the powerlessness of businesses. And there’s a difference between the bookstore, and Visa and Mastercard, by the way, and their capacity to have any control over what costs are when the well-being and their capacity to survive is beneficial to the citizens in all of our communities. And they’re getting hammered constantly.”

Senator Welch had the following exchange with Bill Sheedy, Senior Advisor to the CEO of Visa, and Linda Kirkpatrick, President for the Americas at Mastercard:

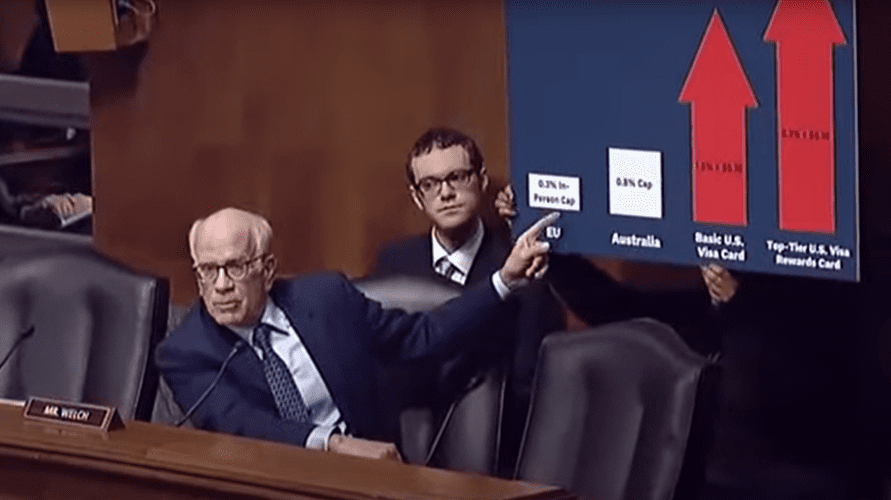

Sen. Welch: “This is another issue: 3/10 of a percent in person cap in the EU….”

“Visa does business, right, in the EU?”

Mr. Sheedy: “Yes.”

Sen. Welch: “And Mastercard does business in the EU, right?”

Ms. Kirkpatrick: “Yes.”

Sen. Welch: “And all of those wonderful things you described—fraud protection, consumer confidence—you do that in Europe just like you do here in the United States, right?

Mr. Sheedy: “Yes.”

Sen. Welch: “So why not have Mr. Callahan pay the lower rate? And all the Mr. Callahans around the country? What’s the problem? You’re able to do it and make a profit.”

…

Sen. Welch: “You are killing small business in the United States of America.”

Watch the Senator’s full remarks below:

Swipe fees, also called interchange fees, cost American merchants a total of $100.77 billion in 2023, over $7.5 billion more than the year prior and more than any other year in history. One Vermont business recently visited by Senator Welch reported paying over $70,000 in credit card fees in 2023. Visa and Mastercard run a duopoly on the market, enabling them to impose fees that are among the world’s highest—which are then passed on to the consumer in the price of the goods and services they buy.

Under the Credit Card Competition Act, the Federal Reserve would issue regulations that require banks with over $100 billion in assets to enable at least two unaffiliated credit card networks, at least one of which must be outside of the top two largest networks, to process transactions on credit cards the banks issue. This would empower small business owner to pick the network that best suits their needs and inject real competition into the credit card market—opening the door for new market entrants, encouraging innovation and enhanced security, and exerting competitive constraints on Visa and Mastercard’s fees. It is estimated the CCCA would save merchants and consumers $16 billion each year.

In addition to Senator Welch, the CCCA is cosponsored by Senate Majority Whip Dick Durbin (D-Ill.), and Senators Roger Marshall, M.D. (R-Kan.), and JD Vance (R-Ohio).

###